Anyone can fall into hard times financially and we’re going through a time where the cost of living is so high while wages are low in the UK. I’ve always been incredibly frugal having not grown up with much and always scrimped to save, however I’ve never been able to get far with savings because payments always jumpscare me. After a sudden bereavement last year I had to spend all my savings (because even in death it costs) so now I’m starting from scratch again. Which was fine…until my car broke down, my rent, council tax and water bill went up and all my toiletries ran out at the same time!

These things can happen at any time and financial stress is affecting 54% of UK adults.

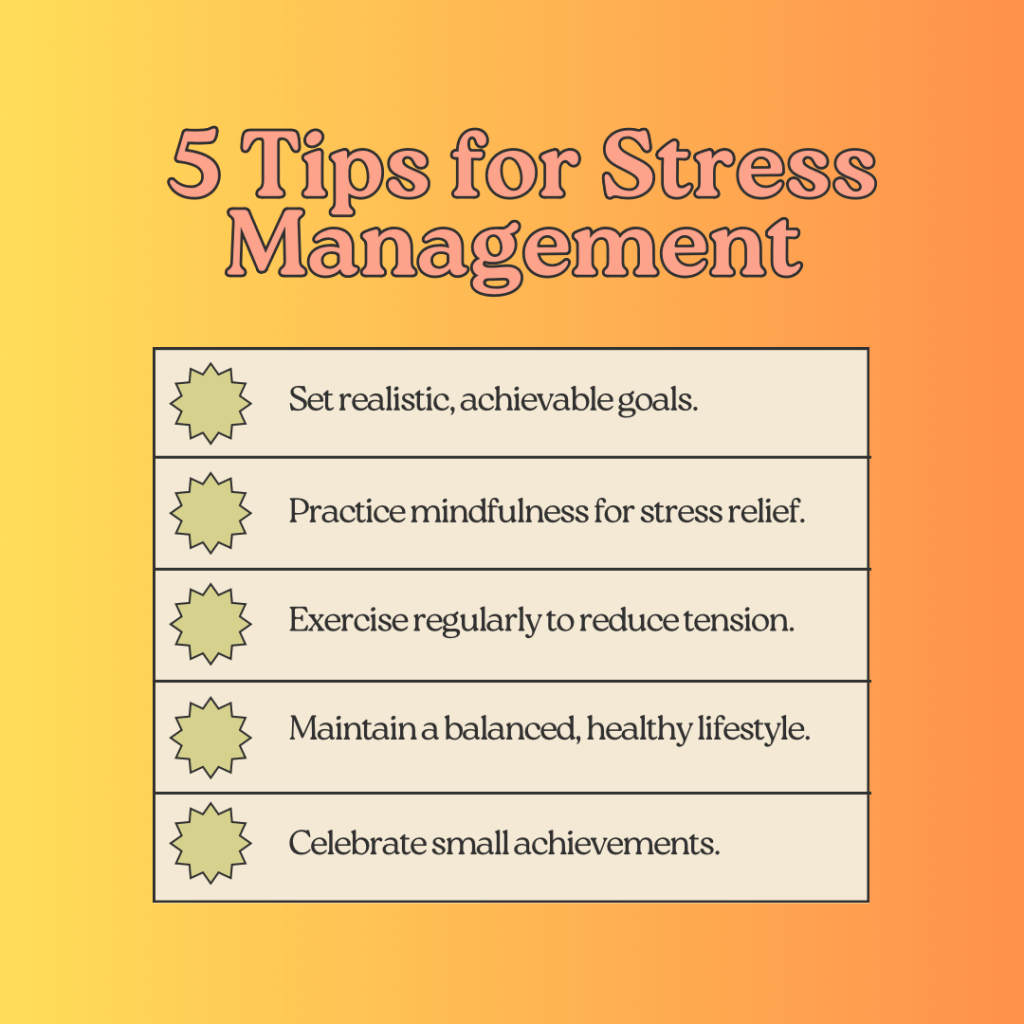

Here are some practical and compassionate tips to help you manage your mental health during financial hardship:

1. Acknowledge What You’re Feeling

First and foremost: it’s okay to not be okay. Stress, fear, guilt, shame, and frustration are all natural responses to financial insecurity. Suppressing your feelings or pretending everything’s fine can make things worse. Give yourself permission to feel—and then channel that energy into action or self-care.

2. Create a Manageable Financial Plan

Uncertainty fuels anxiety. Even a basic budget or plan can give you a sense of control. Focus on small, actionable steps:

Track your expenses to see where your money is going. Prioritize essentials like housing, food, and utilities. Reach out to financial counselors or community resources—many offer free help.

It’s not about solving everything overnight, but about gaining clarity and reducing fear of the unknown.

3. Avoid the Comparison Trap

It’s easy to feel like everyone else is doing better—especially in the age of social media. But remember: people tend to post highlights, not hardships. Everyone’s journey is different, and no one has it all figured out. Be kind to yourself and avoid measuring your worth by someone else’s timeline.

4. Practice Low-Cost or Free Self-Care

Self-care doesn’t have to mean spa days or expensive treats. It can be as simple as:

Going for a walk in nature Journaling your thoughts Calling a trusted friend Meditating or practicing deep breathing

These small acts add up and help regulate your stress levels, especially when done consistently.

5. Stay Connected

Financial problems can be isolating. You may feel embarrassed or tempted to withdraw, but human connection is crucial. Talking to someone you trust—a friend, family member, therapist, or support group—can make a world of difference. You don’t have to carry the burden alone.

6. Limit News and Social Media Intake

While staying informed is important, constantly consuming negative news can increase anxiety and hopelessness. Set boundaries around your media intake:

Designate specific times to check the news Unfollow accounts that make you feel worse Follow uplifting or supportive content to balance things out

7. Seek Professional Help if Needed

If financial stress is leading to anxiety, depression, or affecting your ability to function, it’s okay to ask for help. Therapists and counselors are trained to help you cope, and many offer sliding-scale fees or telehealth options. There are also crisis lines and nonprofit organizations offering free mental health support.

Final Thoughts

Financial hardship can test us in ways we never expected—but it can also lead to resilience, resourcefulness, and community. Prioritizing your mental health is not a luxury—it’s a necessity. Take things one day at a time, and remember: this season is hard, but it won’t last forever. You are not alone, and you will get through this.

Leave a comment